Youth Loans for Weeks

The Weeks children support the family farm with USDA Farm Service Agency Youth Loan projects amidst tragedy.

written by Devon Kenny, edited by John Flocke

The Weeks farm is a typical upstate NY family run farm. There’s mom Dawn riding herd over daughter’s Sarah (22) and Carrie (15) and sons Jeffrey (17) and Samuel (11). Then there’s grandma and grandpa (Dawn’s mom and dad) who live right on the farm in a separate house. Add a menagerie of different animals ranging from dairy cows, beef, pigs, goats, sheep, chickens and rabbits and you have a busy place and a lot of responsibility. Last year tragedy struck when dad Jeff was diagnosed with multiple brain tumors. These were thought to have been a possible result of contaminated water where he served in the US Marine Corps at Camp Lejeune in North Carolina during the 1980’s. Jeff did not survive his battle with the brain cancer and died shortly after he was diagnosed. His death was a crushing blow not only to the family but to the farm itself. The family had to make difficult decisions for the future

to stay in business. The children who were always involved now had to step up and work even harder to take over where dad left off. Despite this tragedy Jeffrey has signed up to join the US Marine Corps and Samuel also has plans to join as soon as he is of age. This all-American family not only personifies dedication and valor in the face of adversity but proves that loyalty and hard work can overcome anything.

One might say that helping to run a farm is a lot of responsibility to place on children, but these are not your average kids. Not only do they all excel in school but the oldest three have all applied and received agricultural loans through the Farm Service Agency (FSA) Youth Loan Program. The FSA Youth Loan Program makes operating loans of up to $5,000 to eligible youths ages 10 to 20 to finance income-producing, agriculture-related projects. The project must be of modest size, educational, and initiated, developed and carried out by youths participating in 4-H Clubs, FFA, or a similar organization. The Weeks received help in submitting business plans from their advisor Marion Jaqueway from the local 4-H chapter. The FSA Youth Loan Program encourages young adults to get experience in business and financial-planning by allowing them to plan for and market their product. It also helps to build credit and give youths a better understanding of fiscal planning, market gains/losses and commodity management.

Sarah was the first to receive a loan through the FSA Youth Loan Program. The application included preparing a business plan that showed what she was interested in purchasing, the budget she would need along with plans of how she was going to pay off her loan. Sarah used her loan funds to purchase sheep and metal pens and gates for

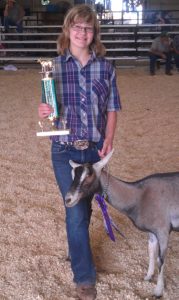

housing. She cared for and showed the sheep while making a profit from breeding and selling them to other farms. Sarah also sells the meat at the local year round farmers market in Ilion, NY where the Weeks family markets their beef, pork, lamb, goat and eggs every weekend. Sarah has since paid off her loan and now has a flock of 35 registered shropshire sheep. Jeff followed in his big sister’s footsteps when he applied for a loan to buy pigs and farrowing crates. Jeff owns 10 sows and raises feeder pigs up to finished hogs to sell. He has established himself as a well-known pig breeder and showman. In July he shipped out to US Marine Corps boot camp. He will be serving in the Reserves unit out of Syracuse and is planning on starting college at SUNY Cobleskill for agricultural engineering in January. His long term plan is to take over the family farm. Younger siblings Samuel and Carrie will be caring for his stock while he is away. Carrie has also obtained an FSA Youth Loan to purchase high tensile fencing and goats. She, like her older siblings, cares for and shows the animals herself. Carrie raises both meat and dairy goats. She also milks the family’s dairy cow herd every day. Her brother Jeff complains that no matter what he does she always milks ten minutes faster than he does and manages to get more milk out of the cows. Even Samuel plans to get into the industry. He now keeps rabbits, chickens and a few pigs at the farm and plans to apply for a youth loan to expand that operation. While they all seem to be natural born farmers there is a lot of work that goes into raising and marketing these animals. The Weeks family works through USDA certified Kelley’s Meat Market in Taberg, NY to process the animals for market. Raising and caring for these animals from birth to market gives these youths a great appreciation for where their food comes from and how much work really goes into making a ham sandwich.

Farm Service Agency Youth Loans are an excellent resource for ambitious hard-working youths interested in agriculture to gain real world knowledge. Loan funds may be used to pay operating expenses for the project and buy livestock, seed, equipment and supplies as well as buy, rent or repair needed tools and equipment. Applicants must submit completed plans and budgets signed by the project advisor and parent/guardian along with the FSA application for loan assistance. For more information on FSA Youth Loans please visit www.fsa.usda.gov or contact your local FSA office.

Devon Kenny is a Program Technician at the USDA Farm Service Agency office in Marcy, NY.

What an interesting story! Thanks for the article. I took out a loan before the caronovirus pandemic and then things got difficult and I couldn’t pay it off. Now I have a bad credit history. And my farm needs to be modernized, some things need to be added to get the work going. But now things are not going well for me and I can’t get a loan. I don’t even know what to do to get out of this situation.

Business loans can be difficult to secure if you have bad credit. Small business owners with bad credit scores often find it challenging to secure financing. For this purpose, you visit many companies where are many professionals and experts that guide and help in a better way.

Super! Its interestings!

Super! Its goooood!

I’m sorry to hear about your situation, and I can understand how challenging it must be with a bad credit history. One option you might consider is exploring short-term business loans https://www.gofundshop.com/short-term-business-loans/ . These loans are designed to provide quick access to capital for businesses in need, and they often have more lenient credit requirements compared to traditional loans. It’s essential to research different lenders and their terms to find one that suits your needs and can help you with the modernization of your farm. Additionally, working on improving your credit over time will also open up more financial opportunities for you in the future. Good luck!