Smart Marketing for Specialty Mushrooms

Results from a 2021 survey of specialty mushroom growers around the USA offer an interesting glimpse into this growing industry.

By Kristen Park and Steve Gabriel

Anyone who is serious about making money with the sale of mushrooms should plan on devoting equal time to learning how to best grow high quality mushrooms as well as the multiple aspects of running a small farm enterprise. Cornell Small Farms Program

In January 2021, the Cornell Small Farms Program conducted a survey of specialty mushroom growers about their cultivation and marketing practices. We want to thank the growers for providing this valuable information which benefits the specialty mushroom industry and helps us develop our future research and education for growers.

When we talk about specialty mushrooms, we are not including the white button mushroom or even the portobella or cremini mushrooms which are all Agaricus bisporu. Rather, we are talking about specialty mushrooms that include shiitake, oyster, lion’s mane, and king oyster, and others. These species tend to be more fragile to cultivate, pack, and transport. Thus, local producers have an opportunity to grow and sell specialty mushrooms to local markets which prioritize fresh and high-quality product.

Based on increasing demand for information from the Cornell Small Farms’ specialty mushroom program in the last decade, our sense was that the interest and adoption of mushroom farming was on the rise. Therefore, we surveyed mushroom farms to find out more about their operations and markets.

From our survey, we found that most of our respondents, two-thirds of them, grow specialty mushrooms as part of a diversified farm, alongside other crops such as vegetables, forestry products, fruit, and livestock. The remaining respondents are specialists and grow and sell only fresh mushroom.

In general, the operations are small, with 72.9% of respondents selling less than $50,000 in annual farm gross receipts. Growers use an average of 3.3 persons for their workforce, which was reported as self, family, or outside labor.

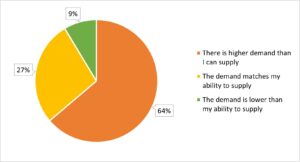

Figure 1. Demand for Growers’ Specialty Mushrooms. Cornell Small Farms Program

Many respondents reported a higher demand for specialty mushrooms than they could supply (Figure 1). This was true for respondents regardless of size.

Popular Mushrooms and Products

What kind of mushrooms are specialty growers producing? Shiitakes are the most popular specialty mushroom species, grown by 79.7% of respondents. Although shiitake is the most popular, oyster and lion’s mane cultivars are also very popular as well as several other emerging species including king oyster, chestnut, maitake. Still others are found wild by foragers.

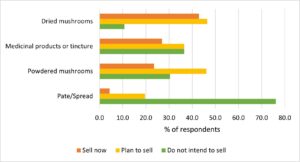

Selling value-added products made from specialty mushrooms is a large part of many of our respondents’ businesses. About two-thirds of growers also make and sell value-added products, including dried mushrooms, tinctures, powdered mushrooms, and pâtés. Dried mushrooms are the most popular value-added product sold by respondents, and just as many respondents, although not selling them currently, plan to do so in the future (Figure 2). Powdered mushrooms also are sold as a condiment or flavoring. Although not as many respondents are currently selling powders, many of them, 46.1%, plan to in the future.

Figure 2. Mushroom Products Sold by Respondents, Current and Future Items. Cornell Small Farms Program

Prices

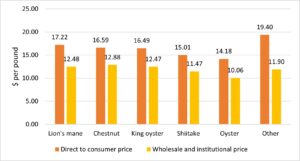

Our mushroom growers sold most of their products at farmers markets, CSAs or at a grower’s farm stand, and prices received by our survey respondents through these direct-to-consumer markets were higher than prices for wholesale markets, such as restaurants, retailers, and institutions. The average direct-to-consumer price for all specialty mushrooms was $15.99 while the average wholesale and institutional price was $11.62, about 73% of what the direct price was.

In direct-to-consumer markets, “other” mushrooms were the highest priced ($19.40) (Figure 3). These ‘other’ mushooms included wine cap, pioppino, strophia, maitake, coral tooth, black pearl, morel, lobster, bears head, reishi, almond, comb’s tooth, chanterelles, and chicken of the woods. Many of these types of mushrooms are often either foraged or are very specialized. Lion’s mane ($17.22), chestnut ($16.59), King oysters ($16.49) and shiitake ($15.01), were priced in the middle, and oysters were the lowest priced ($14.18).

Quality and locally grown influence how much growers can charge. The high quality and local nature of a product may support higher prices. Some other factors influencing price often include proximity to urban markets or tourist areas as well as presence of competition from other producers in the same market.

Figure 3. Comparison of Direct-to-Consumer versus Wholesale Prices. Cornell Small Farms

When setting prices for products, it is important not to just copy what is seen “in the market” but also balance demand for your products with the ability to pay for all production, marketing, and ownership labor, and management costs. Growers need to understand how to price their products as a critical function of their enterprise. See the resources at www.CornellMushrooms.org for more information.

Final thoughts

The survey results seem to offer a promising opportunity for established and new growers, where market demand remains higher than supply, high quality and locally produced mushrooms are valued, and where pricing remains high on a per pound basis. The price points and reports of high demand is notably still positive almost ten years after we first heard this from growers.

The specialty mushroom project of the Cornell Small Farms Program will take these research results and continue to develop useful, targeted materials for specialty mushrooms growers. There are many supporting resources available at the main site, www.CornellMushrooms.org, including growing guides, webinar recordings, and information on marketing, regulations, and other aspects of running a specialty mushroom enterprise.

This material is based upon work supported by the National Institute of Food and Agriculture, U.S. Department of Agriculture and the Northeast Sustainable Agriculture Research and Education program under sub award number ENE19-156-33243.

Visit https://cornellsmallfarms.com/2021-mushroom-survey for the full results.

A version of this article also appeared in “Smart Marketing,” a newsletter for extension publication in local newsletters and for placement in local media.