B. When Am I A Farm?

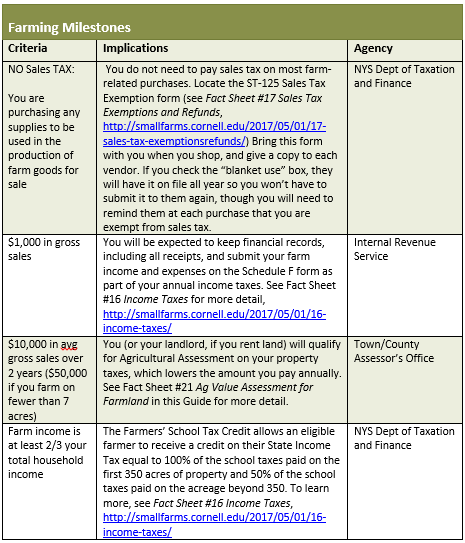

The answer to this question varies, as different programs and agencies each have their own thresholds for what is officially considered a farm. Below are some basic first steps to follow to create a farm business and start generating sales. The table following the checklist provides some information sources for understanding what it means to hit various sales levels.

Checklist for Starting a Farm

- Register your farm name as a DBA (“Doing Business As”) or an LLC – Consult Fact Sheet #13 Business Structures in this Guide to learn more about how to do this, and other options for legal structures. Do a thorough search online of any farm name you are considering, to see who else is using it, and whether the website URL and social media handles you want are available.

- Open a business bank account – from the very beginning, you should keep your farm income and expenses separate from your household finances. Open a bank account in the name of your farm business, and transfer some seed money into it so you’ll have funds to purchase your start-up supplies. If you use personal savings for this seed money, keep track it as your equity in the farm business. If you use a loan, you’ll need to track that too, which leads to the next step:

- Choose a method to track expenses (save receipts) and income – see Fact Sheet #15 Record Keeping in this Guide for some options.

- Register your farm with the Farm Service Agency (FSA) and get a farm # - The FSA is the financial arm of the US Dept of Agriculture. They maintain an office in nearly every county; search online to locate the one that serves farms in your area. Why is it important to register with them? Two reasons: you will be counted as part of the Ag Census, and whenever there are programs that could provide funding or conservation assistance to your farm—like farm loans, crop insurance, disaster assistance compensation, or cost-share on fencing or pollinator planting--you will already have a record set up with the FSA. And you’ll be on their contact list so you are more likely to hear about upcoming funding sources!

- Get Farm Insurance, including Product Liability – see Fact Sheet #5 Farm Risk Management and Fact Sheet #6 Farm Insurance in this Guide for an overview on types of insurance and considerations as you shop around.

- Start selling crops or livestock (Note: Some benefits of being a farm are applied as soon as you start producing a multi-year crop – like perennial woody species or beef cattle – rather than when you start selling.)

- Include your farm sales and expenses on your annual tax return – IF you make $1,000 in sales, you should file a Schedule F with your federal taxes. It’s worth finding a tax accountant with farm expertise to help with your taxes, as there are many special considerations for farms with which general tax preparers or accountants are not likely to be familiar. See Fact Sheet #16 Income Taxes for more detail.

C. Taxes & Agricultural Assessment

Agricultural assessment allows eligible farmland located in or outside agricultural districts to be taxed at its agricultural value rather than market value. It can make a difference in the amount you pay in property taxes. You will be paying taxes based on the agricultural value of land determined each year by the state, not by local market conditions. In most cases the state’s values per acre are lower than your property’s assessed value unless you happen to be in a county where assessed values are low.

How does the exemption work?

The exemption you receive is the difference between the local assessed value and the state’s agricultural values. The state publishes agricultural values annually for 10 soil groups and for woodlands.

To qualify for agricultural assessment:

- Must have 7 acres or more of land in production for sale of crops, livestock or livestock products

- The same farmer must farm the land for at least 2 years

- Farming enterprises must generate $10,000 in sales (average for the preceding 2 years)

- A combination of enterprises generating $10,000 in sales will qualify.

- Up to $2,000 in wood product sales (timber, logs, posts, firewood) can qualify towards the $10,000 minimum. The only forest products that can be used entirely toward the $10,000 mark are mushrooms and maple syrup

- Start-up farms are eligible, if they generate $10,000 in sales in the first year of operation

- Farms less than 7 acres qualify if they generate $50,000 in sales

- If at least 7 acres of land owned by a rural landowner is rented to a farmer (who meets the income requirements), it is eligible for agricultural assessment provided the landowner has a 5 year written lease with the farmer. The renting farmer must generate at least $10,000 in sales from their entire operation, of which only a part might be the rented land.

Application Process

-

- Go to the county Soil and Water District Conservation office (SWCD) – complete a soils group worksheet. All land qualifying for agricultural assessment is grouped by soil type. SWCD will do this for you – there may be a fee and you will need your tax parcel numbers.

- Take the completed soils worksheet to your town/county assessor and obtain copies of the Agricultural Assessment Application (form RP-305). Complete one form for each parcel. The assessor will keep the soils worksheet on file. Make copies of the soils worksheet and application for your records.

- Agricultural assessment applications must be filed every year prior to the taxable status date (March 1). Agricultural assessment is not automatic – you must apply every year by the taxable status date. If you fail to apply, you will not receive the exemption. If no changes have been made in land used for farming, then after the initial application, you will file a short form RP-305-r.

- If you buy or sell land, make sure you complete a new soils worksheet and file a new Agricultural Assessment form to reflect the changes.

Rented Land– land rented to a farmer for agricultural production is eligible for ag assessment if there are at least 7 acres used in the two preceding years and the land is

Renting land to a qualifying farmer is a way for rural landowners, who do not farm, or small farmers who do not use all their land, to receive an agricultural exemption on land that is rented.

Where to get more information

- Start with your County Assessment Department

- Visit with your Town Assessor

- NYS Department of Taxation and Finance website: http://www.tax.ny.gov/pit/property/default.htm